Understanding Liquidation Price and Fee Simulation

Real‑Time Position & PnL Monitoring

Why it matters

Markets can move in milliseconds. Seeing your open positions, unrealized PnL, and liquidation risk in real time lets you seize opportunities and cut losses quickly.

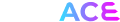

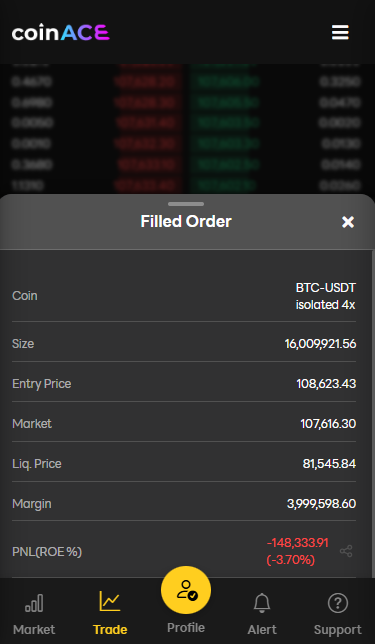

1 Position Panel at a Glance

Field | Meaning | Visual Cues |

|---|---|---|

Position Size | Contracts / coins you hold | Green for Long, red for Short |

Entry Price | VWAP of all fills that built the position | Auto-updated when you scale in/out |

Mark Price | Fair price set by the exchange | Used for liquidation and live-PnL math |

Liquidation Price | Price at which margin goes to 0 | Row flashes red + alarm when near |

Unrealized PnL (USDT / %) | Floating profit or loss | Updates every 200 ms |

Realized PnL | Profit or loss already locked in | Increases when you partially close |

2 How Live Updates Work

Tick-by-tick streaming — Every price tick pushes a new PnL value.

Mark-price driven — Prevents manipulation during rapid spikes; keeps liquidation math fair.

Color & animation

Profit > 0 → green digits with slow pulse

Loss < 0 → red digits with quick blink

Liquidation imminent → entire row turns crimson + sound alert

3 PnL Formula Reference

Unrealized PnL = (Mark Price − Average Entry Price) × Position Size × Contract ValueROE % = Unrealized PnL ÷ Margin Used × 100Contract Value is 1 for coin-margined contracts; USDT-margined contracts adjust automatically.

Fees and funding are subtracted when PnL becomes realized.

4 Mobile vs Desktop Differences

Feature | Desktop | Mobile |

|---|---|---|

Multiple positions visible | Up to 10 rows at once | Swipe between tabs |

Real-time animation | Full-row highlight | Numeric color change only |

5 Risk-Management Tips

Always add TP/SL — One click in the position row protects every trade.

Check your leverage — Higher leverage brings the liquidation price closer.

Test in Simulation first — Watch live PnL flow without risking capital.

6 Frequently Asked Questions (FAQ)

Q. What’s the difference between Simulation Trading and the live exchange?

A. In Simulation Trading, every order fills entirely at the quoted price, no matter what the order-book depth shows. There is no slippage or partial-fill risk.

Q. My PnL updates seem slow—why?

A. CoinACE refreshes charts and the order book via the public Binance API. Because we depend on an external feed, you may notice a small delay between live market moves and on-screen PnL updates.

Q. How do I export my trade records to CSV?

A. Go to Investment → Order History or Investment → Trade History and click Export to download the data in CSV format.

Stay informed in real time, manage risk proactively, and make faster, smarter decisions with CoinACE!